tax on venmo money

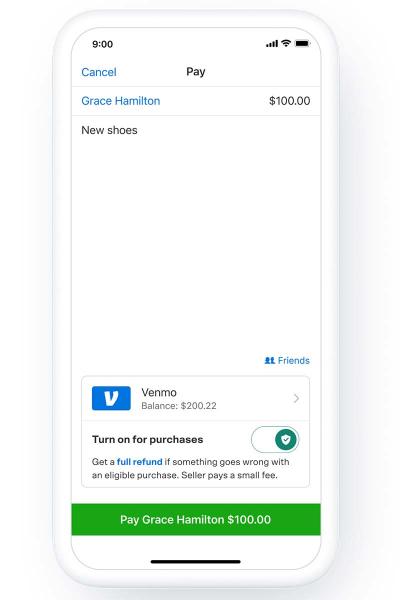

While you cant link Venmo to PayPal directly you can still make a transfer from one platform to the other. But Venmo charges sellers 19 plus 010 per transaction through the app.

3 Ways To Avoid Taxes On Cashapp Venmo Paypal Zelle Legally Youtube

Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to report all aggregate business payments of 600 or more to the IRS through a 1099-K form.

. Which means that Venmo payments are handled as regular PayPal transactions also including the Venmo-funded payments made from a PayPal account. How to add money to Venmo. There has been a flurry of furious cash app users this past week angrily responding to rumors of President Joe Bidens new tax reporting plan requiring taxpayers to report all Venmo and cash app.

Venmo is the fast safe social way to pay and get paid. Under the American Rescue Plan Act people who sell goods or services on platforms like Etsy eBay and other sites that use third-party transaction networks like PayPal Cash App and Venmo will be issued a tax form called a 1099-K for online sales totaling 600 or more starting next year. Beginning January 1 2022 the Internal Revenue Service IRS implemented new reporting requirements for payments received for goods and services which will lower the reporting threshold to 600 for the 2022 tax season from 2021s.

This new rule wont affect 2021 federal tax returns but now is the time to. This can be done by following the steps. This new tax rule only applies to payments for goods and services not for personal payments between.

Sending money on Venmo is very simple and this 7-step guide will show you exactly how to do it. Tax implications of using P2P apps. Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to report all aggregate business.

Which tax forms can I expect to receive from Venmo. Venmo PayPal and other payment apps have to tell the IRS about your side hustle if you make more than 600 a year. These peer-to-peer P2P payment systems use EFT technology to move money.

For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence. Which is better for your needs. The app lets you link a debit card credit card or a bank account and from there you can send money to anyone in the US.

Going forward third-party payment companies will issue you a 1099-K tax form each year if you earn 600 or more annually in income for goods or services. Create a Venmo account. Maximum Refund Guarantee Maximum Tax Savings Guarantee - or Your Money Back.

You can send money with a few taps and swipes. Venmo is unique in that it has a social networking component. Until this year anyone with less than 20000 in total payments typically didnt get a 1099-K.

Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year. This tax form might include taxable and. Most Venmo competitors like Squares Cash app share the same core feature.

Venmo for Business. Venmo is a payment method similar to PayPal that allows you to request send and receive money on your Android or Apple device. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the IRS.

SEND AND RECEIVE MONEY Pay and get paid for anything from your share of rent to a gift. Millions of small business owners in America fell under the rules implemented last March as part of the American Rescue Plan Act to help with the US response to the Covid pandemic. Will I have to pay taxes when sending and receiving money on PayPal and Venmo - what exactly is changing.

To start using Venmo. Send Receive Pay with Venmo. When sending money on Venmo users.

Like PayPal or Venmo. Venmo issued me a credit for the seller. PayPal Venmo and Cash App have made it possible for users to process transactions as friends and family.

That changed in 2016 when Venmo began allowing some businesses to accept Venmo for payment. More than 60 million people use the Venmo app for fast safe social payments. I left the money in my Venmo account and a week after it was sent to me a payment refund for 500 went through and took the money from my Venmo balance.

Apps like Cash App PayPal and Venmo make it easy to send funds from person to person in a flash. Venmo is a digital wallet that makes money easier for everyone from students to small businesses. Starting next year if you sell a bike or an old camera on eBay the tax man wants to know.

All custody of and trading in cryptocurrency is. Join over 83 million people who use the Venmo app today. GET REWARDED WITH THE VENMO C.

How to transfer money from Venmo to PayPal. Add a note to each payment to share and connect with friends. Best Tax Software Best Tax Software For The Self-Employed 2021-2022 Tax.

Anyone who receives at least 600 in payments for goods and services through Venmo or any other payment app can expect to receive a Form 1099-K. Thats the tax form for disclosing transactions with services such as PayPal Venmo and Airbnb. Heres how you can avoid paying taxes when using Zelle Credit.

If you get a larger refund or smaller tax due from another tax preparation method well refund the applicable TurboTax federal andor. Under the American Rescue Plan Act people who sell goods or services on platforms like Etsy eBay and other sites that use third-party transaction networks like PayPal Cash App and Venmo will be issued a tax form called a 1099-K for online sales totaling 600 or more starting next year. Beginning in January 2022 anyone who sells more than 600 worth of goods through on the online auction site or rivals like Etsy or Facebook Marketplace will receive a 1099-K form detailing the transactions for the IRS.

Zelle and Venmo allow you to transfer money quickly to family and friends. Venmo business accounts are. Consider seeking advice from your financial and tax advisor.

Venmo is a service of PayPal Inc a licensed provider of money transfer services NMLS ID. Give your Venmo user name or the email or phone number associated with your Venmo account to the sender. You can choose to keep your money in Venmo or transfer it to a linked bank account.

You can also link your account to a bank account debit card or credit card.

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

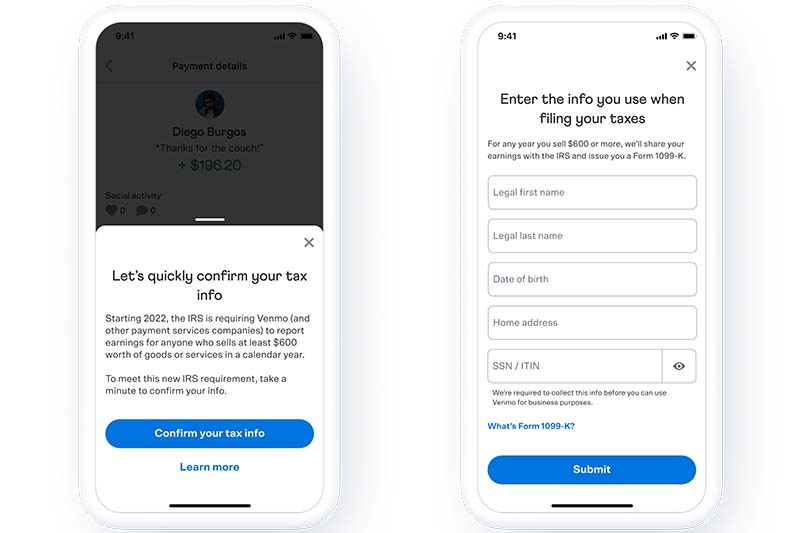

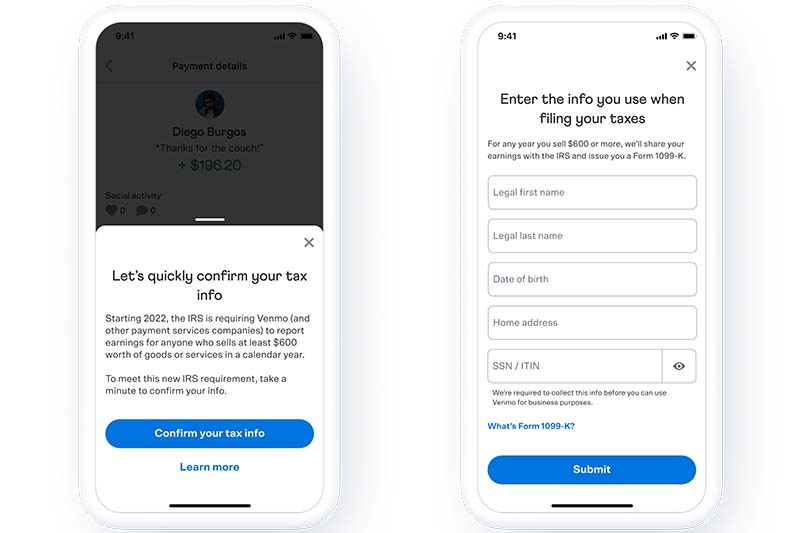

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Boston News Weather Sports Whdh 7news

How To Handle Your Taxes When You Re Paid Through Venmo Paypal And Others Gobankingrates

No Venmo Isn T Going To Tax You If You Receive More Than Us 600 Tech

Tax Day Venmo And Paypal Users Face More Paperwork Under New Us Rules Us News The Guardian

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

/images/2022/02/08/cash-app-and-venmo.jpg)

What Venmo And Cash App Users Need To Know About New Tax Rules Financebuzz

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You

Venmo 1099 Taxes Explained Clearly How Will Venmo 1099 Income Be Taxed Youtube

New Tax Rule Ensure Your Venmo Transactions Aren T Accidentally Taxed Gobankingrates

No Venmo Isn T Going To Tax You If You Receive More Than Us 600 Tech

The Taxman Cometh The Irs Wants In On Your Venmo

Truth Or Hoax Is The Irs About To Tax Your Venmo And Zelle Transfers Nbc4 Wcmh Tv

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You 6abc Philadelphia

Tax Law Changes Could Affect Paypal Venmo And Cash App Users